Chicago-area homeownership rate dips Residential News Crain's Chicago Business

Some very important points in this article. How do you think this affects you?

Real Estate Discussions for Real People. What's going on in the market. What does this mean to me. What can you do to buy or sell your home.

Thursday, November 3, 2011

Wednesday, November 2, 2011

New buildings and new plans in Streeterville

Affordable housing plan dies in Streeterville. Should it have?

Read more: http://www.chicagobusiness.com/article/20111102/BLOGS02/111109941/affordable-housing-plan-dies-in-streeterville-should-it-have#ixzz1ca4HOeuv

Read more: http://www.chicagobusiness.com/article/20111102/BLOGS02/111109941/affordable-housing-plan-dies-in-streeterville-should-it-have#ixzz1ca4HOeuv

The above article by Greg Hinz brings up some good points and good ideas.

Monday, October 17, 2011

Graphical image of housing price comparisons by zipcode

Based on information from Fiserv the Crains Chicago Business has made the following image available. Some zip codes are down less than others compared to last year. Take your time and check it out...

http://www.chicagobusiness.com/article/20111013/PAGES/111019967

http://www.chicagobusiness.com/article/20111013/PAGES/111019967

Friday, October 7, 2011

From John Fritchey Cook County Commissioner -- Property Tax Workshop

Upcoming Property Tax Workshop for Taxpayers in Lakeview Township Nobody wants to pay more in taxes than they are supposed to. If your property taxes are too high, you have every right to appeal them. Lakeview Township will soon open for appeals with the Cook County Board of Review, providing taxpayers in the township an opportunity to file an appeal of their taxes. To help you with this process, I, and Cook County Board of Review Commissioner Michael Cabonargi, will be hosting an appeals workshop to answer any questions you may have and to assist you with filing an appeal. Details are as follows: When: Thursday, October 20, 6:00-8:00pm Where: Saint Luke, 1500 West Belmont Ave What: Representatives from the Board of Review will explain the appeals process, answer questions and assist taxpayers in filing their appeals. **Please remember to bring your most recent property tax bill**

For more information, please call Bridget at 773-871-4000 or e-mail bridget@fritchey.com

Understanding Your Property Tax Bill It's that time of year again...property tax bills are making their way into your mailboxes. Because many of you may have seen the assessed value of your home go down, you might feel a sense of sticker shock when your property tax bill has increased. Or maybe your assessment stayed the same, but your bill grew sharply. As a way to help my constituents understand why this might be happening, I want to provide this property tax overview to answer some questions you may have. Taxing districts - from schools and parks to libraries and cities - need money to operate. They get this money from property taxes. Generally speaking, from one year to the next, tax levies will remain the same regardless of changes in property values. Taxing districts still need money to cover their bills even though home values in the area may have gone down (the same holds true if home values increase).

If my property value assessment went down, why are my property taxes going up? An assessment is basically an estimate of what a piece of property is worth. This valuation of the property helps decide what part of the local property tax levy will be billed to the property - basically, it helps the Clerk figure out who pays what. But remember, your assessment is only part of the overall equation... Tax rates are calculated by using the amount of dollars levied by the taxing district, the value of all taxable property located within its boundaries, and a state-issued equalization factor.

There are two main reasons your property taxes may have gone up this year: 1. The major City of Chicago taxing districts have asked for a 3.4% increase in property tax revenue - going from $2.001 billion last year to $2.118 billion this year. Much of the overall increase is due to the Chicago Board of Education asking for a $117 million dollar increase in funding. To put it in simple terms, if the whole pie gets bigger, so may your slice... 2. The Alternative Homeowners Exemption (also known as the 7% Homeowner's Exemption), is decreasing per state law and will be fully phased out in 2 years. As the the temporary exemption is phased out, the relief provided by it gets smaller.

For more information, please call Bridget at 773-871-4000 or e-mail bridget@fritchey.com

Understanding Your Property Tax Bill It's that time of year again...property tax bills are making their way into your mailboxes. Because many of you may have seen the assessed value of your home go down, you might feel a sense of sticker shock when your property tax bill has increased. Or maybe your assessment stayed the same, but your bill grew sharply. As a way to help my constituents understand why this might be happening, I want to provide this property tax overview to answer some questions you may have. Taxing districts - from schools and parks to libraries and cities - need money to operate. They get this money from property taxes. Generally speaking, from one year to the next, tax levies will remain the same regardless of changes in property values. Taxing districts still need money to cover their bills even though home values in the area may have gone down (the same holds true if home values increase).

If my property value assessment went down, why are my property taxes going up? An assessment is basically an estimate of what a piece of property is worth. This valuation of the property helps decide what part of the local property tax levy will be billed to the property - basically, it helps the Clerk figure out who pays what. But remember, your assessment is only part of the overall equation... Tax rates are calculated by using the amount of dollars levied by the taxing district, the value of all taxable property located within its boundaries, and a state-issued equalization factor.

There are two main reasons your property taxes may have gone up this year: 1. The major City of Chicago taxing districts have asked for a 3.4% increase in property tax revenue - going from $2.001 billion last year to $2.118 billion this year. Much of the overall increase is due to the Chicago Board of Education asking for a $117 million dollar increase in funding. To put it in simple terms, if the whole pie gets bigger, so may your slice... 2. The Alternative Homeowners Exemption (also known as the 7% Homeowner's Exemption), is decreasing per state law and will be fully phased out in 2 years. As the the temporary exemption is phased out, the relief provided by it gets smaller.

Friday, September 30, 2011

Spaces - Real Estate Transaction - Mortgage Contigency

The mortgage contingency is often key to a successful transaction. This is provides that the buyer will obtain a mortgage for a set amount, down payment, rate and duration by a particular date. That date is usually the amount of time that the buyer and their bank has determined it will take to confirm all the details of their financing. The buyer, and their attorney, must notify the seller if the date cannot be met, and request an extension of this date. With no notice the contingency is waived. If the buyer cannot get the financing described, the seller can find a commitment for them, in a specified time frame. To show that they have the ability to meet this contingency, buyers provide letters of pre approval from their banks. To a seller the best offer does not have this contingency, and would be a cash offer.

Tuesday, September 27, 2011

Spaces - Real Estate Contingencies -part 2

The second frequent contingency is for attorney review time period. Offers to purchase are made on standardized forms and the details are worked out between the buyer and seller during their negotiations. Once both have signed and the contract is accepted by both parties, the contract is given to the attorneys for each side of the transaction. They have a specified time to review the contract, and the legal details of the property and to make any clarifications to the details that were worked out during negotiations or issues that arise from inspection or any other due diligence that is done on the behalf of their clients. The attorneys cannot change the price that was offered for the property, but they do negotiate credits for items found in inspection or in the legal description of the property or its title, as well as clarify and explain any condominium documents.

Wednesday, September 21, 2011

Assistance in making mortgage payments

Illinois Launches Hardest Hit Program

The new Illinois Hardest Hit program aims to help working Illinois families who are having trouble making mortgage payments due to unemployment or under-employment stay in their homes. The Illinois Housing Development Authority (IHDA) has partnered with the U.S. Department of Treasury to offer temporary mortgage payment assistance. Qualified homeowners can receive up to $25,000 over 18 months as a 10-year loan to keep mortgages current and make ongoing payments, including fees and penalties. Go to http://lyris.illinoisrealtor.org/t/334220/16491058/3867/0/ to learn more.

The new Illinois Hardest Hit program aims to help working Illinois families who are having trouble making mortgage payments due to unemployment or under-employment stay in their homes. The Illinois Housing Development Authority (IHDA) has partnered with the U.S. Department of Treasury to offer temporary mortgage payment assistance. Qualified homeowners can receive up to $25,000 over 18 months as a 10-year loan to keep mortgages current and make ongoing payments, including fees and penalties. Go to http://lyris.illinoisrealtor.org/t/334220/16491058/3867/0/ to learn more.

Wednesday, September 14, 2011

Chicago Videos 2011 and 1948

Thanks to this blogger for creating a link to two wonderful films of our City. Check them out.

http://www.chicagonow.com/chicago-ground-up/2011/09/chicago-then-now-two-short-videos/

http://www.chicagonow.com/chicago-ground-up/2011/09/chicago-then-now-two-short-videos/

Monday, September 12, 2011

Spaces - Real estate transaction contingency 1

One of the common contingencies to an offer to purchase a property is for an inspection. This is generally done by a licensed inspector hired by the buyer to take a more detailed look at the property. The inspector spends time testing the mechanical aspects of the property and looking for any safety or heath defects that should be addressed before changing ownership of the property.

Saturday, August 20, 2011

Garfield Conservatory races against the weather to protect historic plants

All of us gardeners are mourning the plants we lost in our own gardens this year during the hail storm... The damage to the Conservatory is so much more severe. I'm sure it will be fabulous again one day...

Garfield Conservatory races against the weather to protect historic plants

Garfield Conservatory races against the weather to protect historic plants

Rahm Emanuel announces $20 million loan pool to target foreclosures - Chicago Sun-Times

Rahm Emanuel announces $20 million loan pool to target foreclosures - Chicago Sun-Times

This funding could be a real advantage to some of these great neighborhoods. I'll try to get more details on the ordinance and the qualification details, and post them here as well

This funding could be a real advantage to some of these great neighborhoods. I'll try to get more details on the ordinance and the qualification details, and post them here as well

Wednesday, August 3, 2011

Tuesday, July 12, 2011

What Groupon knows about its subscribers | Consumer | Crain's Chicago Business

What Groupon knows about its subscribers Consumer Crain's Chicago Business

The above article alerts us to the good and the bad abilities of our SmartPhones. Is a great local deal the trade you are willing to make for information about where you are and where you have been?

The above article alerts us to the good and the bad abilities of our SmartPhones. Is a great local deal the trade you are willing to make for information about where you are and where you have been?

Wednesday, June 22, 2011

Existing home prices show gains in Chicago

Here's an article from the Chicago Tribune - good news but not great news - It's really too soon to make any real decisions on where this housing market will go next.

Existing home prices show gains in Chicago

Existing home prices show gains in Chicago

Thursday, June 2, 2011

Green Scene: Tracking the life span of City Trees

Here's an article about the folks that are tracking the success of a charcoal suplement for the trees along Milwaukee Ave in Bucktown and Wicker Park.

http://www.chicagobusiness.com/section/blogs?blogID=ann-dwyer&plckController=Blog&plckBlogPage=BlogViewPost&uid=16ea2629-7e90-46f0-a706-dd6152764513&plckPostId=Blog%3a16ea2629-7e90-46f0-a706-dd6152764513Post%3afd2c398d-ac42-4d53-9460-437f4b03e54d&plckScript=blogScript&plckElementId=blogDest

http://www.chicagobusiness.com/section/blogs?blogID=ann-dwyer&plckController=Blog&plckBlogPage=BlogViewPost&uid=16ea2629-7e90-46f0-a706-dd6152764513&plckPostId=Blog%3a16ea2629-7e90-46f0-a706-dd6152764513Post%3afd2c398d-ac42-4d53-9460-437f4b03e54d&plckScript=blogScript&plckElementId=blogDest

Sunday, May 22, 2011

Chicago Resources Available OnLine

Some of the questions that buyers ask while looking at new homes are never answered by the REALTOR® because to respond would be in violation of the Fair Housing Act. Questions like - How safe is this neighborhood? Or Who else lives in this building? REALTOR® must provide equal professional service without regard to the race, color, religion, sex, handicap, familial status, national origin or sexual orientation of any prospective client, customer, or of the residents of any community. REALTOR® may not encourage any group into or away from any property.

Chicago School Data is available at http://schoollocator.cps.k12.il.us/

Chicago Crime Data is available to you at the Chicago Police Department website. Here is the link to the ClearMap for Bucktown http://gis.chicagopolice.org/website/ClearMap/viewer.htm?POLICEDIST=014 It's very easy to go to any area of the city and great information for residents.

Thursday, May 19, 2011

Square footage: An empty real estate statistic? | Inman News

Here's someone else's commentary on the square foot measurements in housing....

Square footage: An empty real estate statistic? Inman News

Square footage: An empty real estate statistic? Inman News

Monday, May 16, 2011

Cafe, store with local food planned for West Town | News | Crain's Chicago Business

This sounds like a great addition to the area! Looking forward to it!

Cafe, store with local food planned for West Town News Crain's Chicago Business

Cafe, store with local food planned for West Town News Crain's Chicago Business

Monday, May 9, 2011

Priced Right Sells Homes

Home sellers move beyond denial, accept lower values when setting price Business Of Life Crain's Chicago Business

Maybe your house is not over $2 million dollars, but the logic in this article applies to every price point in today's market.

Maybe your house is not over $2 million dollars, but the logic in this article applies to every price point in today's market.

What to do when you are concerned about your parents well being.

'The Talk' With Mom and Dad

Sue Shellenbarger, February 23, 2011

When the time came for Kathy Peel's mother and father to consider moving into an assisted living facility, Ms. Peel tried reasoning with them, citing examples of friends who were happy they had made the move.When that didn't work, she took a business approach. Ms. Peel and her husband Bill convened a conference at her parents' kitchen table in Memphis and helped them write a three-page "strategic plan." Her parents, Morris and Kathryn Weeks — both retired businesspeople in their late 80s — joined in, talking about their goals and helping list dozens of pros and cons to staying in their home.

Among the pros the family agreed on were the Weeks' "positive attitude" and desire to share care for each other. But the cons loomed large, including the fact that no family members lived nearby to provide emergency care in a crisis. Ms. Peel had been forced to make 10 trips to Memphis from her home in Dallas in 2009 to help her parents with health problems, from her mother's heart ailment to her father's failure to notice her bout with dehydration. Ms. Peel printed the plan, and after mulling it for a few weeks, the Weeks agreed to move to a senior-living community in Memphis.

It's an agonizing discussion for adult children: whether elderly parents can no longer live on their own. Some 42% of adults between ages 45 and 65 cite the topic as the most difficult one to discuss with their parents, according to a 2006 survey of 1,000 people by Home Instead Inc., an Omaha, Neb., provider of in-home care. And 31% said their biggest communication obstacle is getting stuck in the parent-child roles of the past.

"We take on old family roles," says Paula Spencer, a senior editor at Caring.com, a caregiving website, and a speaker on elder-care issues. "We don't want to rock the boat. We're concerned about parents' privacy, worried about the consequences, thinking, 'Maybe Dad will hate me if I move him to assisted living.'"

While many seniors do fine at home, others need long-term care facilities or a home aide. It's good to start such conversations early, says Paul Hogan, chairman of Omaha-based Home Instead Senior Care, which provides in-home caregivers. A good principle is "the 40-70 rule; if you are 40, or your parents are 70, it's time to start talking," he says.

Make time to discuss issues without rushing. Research shows adult children who feel hurried during conversations about their parents' changing care needs may tend to push them toward the most efficient option, such as getting more help or moving to an assisted-living facility prematurely, rather than taking the time to encourage them to work on staying independent as long as possible.

About 70% of people over 65 are expected to need some long-term care services at some point in their lives, such as help with dressing or bathing, in-home services from an aide or nurse, or care in an assisted-living facility, according to 2008 federal data. More than 40% will spend time in a nursing home. While the average time seniors need help is three years, 20% are expected to need long-term care services for more than five years.

Take time to assess a senior's entire situation before jumping to conclusions about their weaknesses or desires, says Jake Harwood, a professor of communication at the University of Arizona, Tucson. A parent whose husband dies may suddenly seem unable to care for herself, failing to clean the house or keep up with bills. But the bereaved spouse may simply need more contact with friends and social support to get motivated again.

Also, adult children sometimes misunderstand parents' reluctance to move, says Kenneth Robbins, a clinical professor of psychiatry at the University of Wisconsin in Madison. "They may resist leaving the house because they think their kids and their grandkids are going to miss the house," or they fear that a close neighbor will be left alone, says Dr. Robbins, who is also a senior medical editor at Caring.com. Seniors also may fear having to leave cherished belongings behind or being unable to make friends in a new setting. And some see leaving their homes as an acknowledgment of their increasingly frailty — and mortality.

Robin Joy, of San Francisco, says she helped her widowed mother Gail, 77, hire a professional organizer after figuring out that cleaning out the family's Evanston, Ill., home of 30 years was an obstacle to her moving. Gail says she put her name on a retirement home's waiting list, but passed up a couple of opportunities to move in because the need to sort through all the papers and belongings "seemed overwhelming."

The organizer has since helped Gail get stacks of papers and stuff under control, and she is planning to move soon.

Dementia, of course, raises added issues. People with dementia may "no longer be able to make decisions in their own best interests, and they begin to misinterpret what other people are trying to do for them," Dr. Robbins says. Seniors with dementia may become paranoid, depressed, or so confused that "life becomes a minefield of dangers," he says.

Appealing to a parent's values can help in such cases. Barbara Meltzer of West Hollywood, Calif., says that when her father died several years ago, her aged mother, who was living in Florida and had dementia, resisted Ms. Meltzer's plea to bring in a home health aide. The aide "would call and say, 'Your mother sent me home,'" Ms. Meltzer says.

So she turned the conversation with her mother to, "Please do it for me, Mom, because I'm worried about you." She also mentioned to her mother that allowing the aide to stay helped her by providing a job. "That worked, because my mother was a giver. She was Mother Earth. With her, it was always about helping somebody else," Ms. Meltzer says.

Eventually, she used the same approach to persuade her mother to move to California to live near her and other family members. "We love you so much and it's important to us that you're here," Ms. Meltzer says she told her. Her mother lived nearby for several years before dying last year at the age of 93.

Meanwhile, Kathy Peel's parents have moved into Town Village at Audubon Park, an independent senior living community in Memphis. The pros and cons in the plan they compiled with Ms. Peel and her husband have proven true. Ms. Peel travels often to see them, and the Weeks are considering moving again in the future, to Dallas, to make it easier for the Peels to help them out. "They have realized they really do need us," Ms. Peel says.

Source: The Wall Street Journal

©2011 Dow Jones & Company, Inc. All rights reserved.

Annual Bucktown Tree and GardenWalk

It's time to mark your calendar for the Annual Bucktown Tree and GardenWalk.

Saturday and Sunday - July 9 and 10 - 11 am to 5 pm

Check In at the Welcome Table outside of Club Lucky at 1824 W Wabansia

This is where you can get your official GuideBook for a $5 suggested donation per person.

With the GuideBook in hand you have the map of the one mile square neighborhood and the descriptions and addresses of 100 gardens that are carefullly tended by the owners and residents. You also hold the ticket to unlimited free rides on the Trolley. Get on or off at any stop or one of our local supporting businesses. Enjoy the day exploring our green corners, roofs, yards and parkways. More activites will be added as the event gets closer. Check out http://www.bucktown.org/ for more information.

Saturday and Sunday - July 9 and 10 - 11 am to 5 pm

Check In at the Welcome Table outside of Club Lucky at 1824 W Wabansia

This is where you can get your official GuideBook for a $5 suggested donation per person.

With the GuideBook in hand you have the map of the one mile square neighborhood and the descriptions and addresses of 100 gardens that are carefullly tended by the owners and residents. You also hold the ticket to unlimited free rides on the Trolley. Get on or off at any stop or one of our local supporting businesses. Enjoy the day exploring our green corners, roofs, yards and parkways. More activites will be added as the event gets closer. Check out http://www.bucktown.org/ for more information.

Spaces April 25, 2011

It’s about that time to check your Credit Report. It’s simple and free at AnnualCreditReport.com which provides access to all three of the major credit bureaus. You can do each one free once a year, so the best deal is one every 4 months.

I will be finding out more about my buying ability as I’m in the market for a new car. It’s about time – 14 years is really too long to keep a car. Now I’ll be building my credit score by paying off the car on time every month. At the same time this loan will reduce my mortgage buying ability because it increases my debt to income ratio. Financing is all about balance. (PS – send me your suggestions for a new car – not too big, too flashy, too costly)

Bucktown/Wicker Park closings the last two weeks: 2 Detached single family homes, and 16 Attached homes!

1733 N Hoyne, 4 bedroom, 2 ½ bath home with garage, $780,000

1724 N Winchester, 4bedroom, 3 ½ bath home with attached garage $1,129,000

1937 N Hoyne #3, 1bedroom, 1bath, Condo, garage spot, $234,000

1927 N Milwaukee #204, 2 bedroom, 2 bath Lofted condo $240,000

1742 N Winchester #201, 2 bedroom, 1 ½ bath condo, garage spot $290,000

2213 W Wabansia #2A, 2 bedroom, 2 ½ bath condo garage spot, $310,000 (Foreclosure)

1441 N Wicker Park #3N, 2 bedroom, 2 bath condo, parking spot, $329,500

1731 W Crystal #A, 2 bedroom, 2 bath, Townhouse condo, garage spot, $365,000

1631 W LeMoyne #1, 3 bedroom, 2 ½ bath, Duplex condo, garage spot, $410,000

1640 W Beach #1E, 3 bedroom, 2 ½ bath, Duplex Condo, garage spot, $412,500

1372 N Dean #1, 3 bedroom, 2 ½ bath, Duplex, Condo garage spot, $416,000

1742 N Winchester #203, 2 bedroom, 2 bath, Lofted Condo, Penthouse 2 garage spots, $425,000

2218 W Belden #1, 3bedroom, 2 ½ bath, Duplex condo, garage spot, $443,000

1530 N Paulina #F, 3 bedroom, 3 bath, Duplex, Condo , garage spot $485,000 (Short Sale)

1530 N Elk Grove #D, 3 bedroom, 2 ½ bath, Townhouse, Condo on Courtyard, garage, $485,000

1717 W Julian #2, 3 bedroom, 2 ½ bath, Duplex Condo, garage spot, $530,000

2012 W Willow #C, 3bedroom, 3 bath, Townhouse-garage , $555,000

2028 W Division #4R, 3 bedroom, 2bath, Penthouse Condo, 2garage spots, $701,000

Summary Statistics – 16 Sold Condos -

(High, Low, Average, Median)

List Price, $769,800, $239,000, $444,931, $435,000

Sold Price, $701,000, $234,000, $414,437, $414,250

Listing Market Time, 306, 2, 115, 91

Market Time, 697, 2, 195, 168

Thursday, April 14, 2011

Wednesday, April 13, 2011

Common Contigencies to a Purchase Contract

Spaces April 11, 2011

The offer was accepted - now what?

After the buyer and the seller have come to an agreement on the price and the terms of the home sale, it's time to work on meeting all the contingencies.

Inspection - In most sales, the buyer has a few days to bring in any inspector or other Licensed persons to examine the property and identify any health or safety defects. These are items that are not obvious to the buyer or seller. An example might be that the inspector looks at the basement sink drain and finds a leak. The buyer might ask the seller to have the pipe repaired or pay for the buyer to have it done at a later time.

Attorney Review - Both buyer and seller will have their attorneys look at the terms of the purchase agreement and the attorneys will come to agreement on any terms. This review is usually as long as the inspection period (or a few days longer) and the attorneys will confirm any responses to the inspection items.

Mortgage - Generally the last completed contingency, since the details of confirming the mortgage funding are the most time consuming. The purchase agreement includes a date by which the buyer and their lender must be able to agree that funding is available for this buyer and this property. The agreement also provides some limits for the loan rate and duration. (This is why it’s so important for buyers to be pre-approved!)

Condo Documents - The Condo Declarations and Bylaws, Rules and Regulations, Budget (current and previous year), Minutes and a 22.1 form will all need to be provided to the buyer for their review, and the attorney. Most are required during the attorney review period. They are also needed by the buyer’s lender who will confirm the financial stability of the condo association before authorizing a loan.

Other contingencies could be the sale of a previous home, pet rules, leases, or other items that both buyer and seller agreed to during negotiations and included in the Purchase Agreement.

In Bucktown/Wicker Park this week, there were six closings! Of the six, four were detached single family homes, and two were attached homes. They are as follows.

1850 N Wilmot, 4 bedroom, 3bath, Rowhome, private yard, garage, $595,000

1880 N Hoyne, 5bedroom, 3 bath +2 ½ baths, Contemporary renovation, attached garage, $1,624,625

1627 N Wolcott, 4bedroom, 4 ½ bath, 4+ Stories ultra modern new construction , $1,950,0001804 N Leavitt, 5 bedroom, 4 ½ bath, Modern open conversion of warehouse space, $2,770,000

1524 N Leavitt #1, 4 bedroom, 3bath, 2 garage spots, Duplex Condo, $399,000

1767 N Hoyne #L, 3 bedroom, 2 ½ bath, updated Townhouse Condo, Attached 2 car Garage, $575,000

*** Information sourced from MREDLLC;4/11/11. Attached Property and Detached Property residential Bucktown (Ashland, Western, Fullerton, North) and WickerPark (Ashland, Western, North, Division)

Do you have a topic you'd like to see explored or a real estate question? Send it in. If you'd like more information on properties currently on the market or selling your home just drop me a note.

The offer was accepted - now what?

After the buyer and the seller have come to an agreement on the price and the terms of the home sale, it's time to work on meeting all the contingencies.

Inspection - In most sales, the buyer has a few days to bring in any inspector or other Licensed persons to examine the property and identify any health or safety defects. These are items that are not obvious to the buyer or seller. An example might be that the inspector looks at the basement sink drain and finds a leak. The buyer might ask the seller to have the pipe repaired or pay for the buyer to have it done at a later time.

Attorney Review - Both buyer and seller will have their attorneys look at the terms of the purchase agreement and the attorneys will come to agreement on any terms. This review is usually as long as the inspection period (or a few days longer) and the attorneys will confirm any responses to the inspection items.

Mortgage - Generally the last completed contingency, since the details of confirming the mortgage funding are the most time consuming. The purchase agreement includes a date by which the buyer and their lender must be able to agree that funding is available for this buyer and this property. The agreement also provides some limits for the loan rate and duration. (This is why it’s so important for buyers to be pre-approved!)

Condo Documents - The Condo Declarations and Bylaws, Rules and Regulations, Budget (current and previous year), Minutes and a 22.1 form will all need to be provided to the buyer for their review, and the attorney. Most are required during the attorney review period. They are also needed by the buyer’s lender who will confirm the financial stability of the condo association before authorizing a loan.

Other contingencies could be the sale of a previous home, pet rules, leases, or other items that both buyer and seller agreed to during negotiations and included in the Purchase Agreement.

In Bucktown/Wicker Park this week, there were six closings! Of the six, four were detached single family homes, and two were attached homes. They are as follows.

1850 N Wilmot, 4 bedroom, 3bath, Rowhome, private yard, garage, $595,000

1880 N Hoyne, 5bedroom, 3 bath +2 ½ baths, Contemporary renovation, attached garage, $1,624,625

1627 N Wolcott, 4bedroom, 4 ½ bath, 4+ Stories ultra modern new construction , $1,950,0001804 N Leavitt, 5 bedroom, 4 ½ bath, Modern open conversion of warehouse space, $2,770,000

1524 N Leavitt #1, 4 bedroom, 3bath, 2 garage spots, Duplex Condo, $399,000

1767 N Hoyne #L, 3 bedroom, 2 ½ bath, updated Townhouse Condo, Attached 2 car Garage, $575,000

*** Information sourced from MREDLLC;4/11/11. Attached Property and Detached Property residential Bucktown (Ashland, Western, Fullerton, North) and WickerPark (Ashland, Western, North, Division)

Do you have a topic you'd like to see explored or a real estate question? Send it in. If you'd like more information on properties currently on the market or selling your home just drop me a note.

Thursday, April 7, 2011

Green Thoughts for Pet Owners

Get Earth-Day Ready: Reduce Your Pet’s Carbon Paw-print

Scoop your poop.

American dogs and cats create 10 million tons of waste a year. By picking up after your pooch with biodegradable plastic bags or paper bags, you can keep your pet’s waste from spending years encased in plastic.Clean green.

Here’s a great way to clean up your pet’s accidents on the rug or sofa without harmful bleaches and toxins. First, scrub the soiled area with club soda and let dry. Then, sprinkle with baking soda to help control odors. After an hour or so, vacuum thoroughly. The ACPCA also recommends using diluted white vinegar as an environmentally friendly alternative to commercial products. What’s more, you’ll save money on pricey pet cleaning supplies.Give bottles the boot.

Offer your pet filtered tap water instead of bottled to drink. If you must use bottled in a pinch, be sure to recycle.Dine in.

Want to know exactly what is going into your pet’s food? Make your own organic puppy or kitty chow. While the idea of becoming a fulltime pet chef may be too much, ask your vet about occasionally adding chopped apples, carrots, or greens to your pet’s usual feeding.Walk this way.

Did you know that 40 percent of daily car trips in the U.S. are 2 miles or less? By strolling to the doggie park rather than driving, you not only save fossil fuels, you get in a little exercise to boot.Throw in the towel.

As sheets or towels start to wear, re-use them as doggie bedding, to clean up accidents, or to dry your pooch off after bath time instead of blow-drying. Old towels also make a great chew toy: braid strips into a rope for playing tug-o-war.Bulk up.

Buy pet supplies in bulk or the largest available size. You’ll not only throw away less packaging, you’ll make fewer car trips to the store.Pick your litter.

Up to 8 billion pounds of cat litter wind up in U.S. landfills each year. Instead of using clumping clay litter, try products made from recycled newspapers or sawdust for a chemical-free, environmentally safe litter box.Give back.

Doing a little spring cleaning? Before tossing your old treasures away, call local animal shelters and ask if they need used towels, bedding, leashes, litter boxes, and pet toys.Monday, April 4, 2011

Distressed Sales as Comparables?

It's a concern for everyone who chooses to sell their house or condo - how does the neighbors foreclosure or short sale affect my price and my chance to sell?

Appraisers need to look at the most recent sales - in the last 12 months. When there are multiple distressed sales, with lower prices, this is taken into consideration. The appraiser also must look at the condition of the property. In many cases the distressed sale is also not in the more desireable condition and will require significant work before it can be occupied.

If legislation like what is proposed below can do into effect, what will the outcome be?

http://chicagoagentmagazine.com/four-states-consider-legislation-barring-distressed-sales-as-comparables/?sms_ss=email&at_xt=4d9a16c5c3f99543%2C0

Appraisers need to look at the most recent sales - in the last 12 months. When there are multiple distressed sales, with lower prices, this is taken into consideration. The appraiser also must look at the condition of the property. In many cases the distressed sale is also not in the more desireable condition and will require significant work before it can be occupied.

If legislation like what is proposed below can do into effect, what will the outcome be?

http://chicagoagentmagazine.com/four-states-consider-legislation-barring-distressed-sales-as-comparables/?sms_ss=email&at_xt=4d9a16c5c3f99543%2C0

Tuesday, March 29, 2011

The Stress of Selling your home

This writer has a great attitude and some valuable instights into the Seller Stresses of your house on the market now. My home wrecked me when I tried to sell it - chicagotribune.com

Friday, March 18, 2011

Bigger home loans won’t spur more foreclosures: Realtors | News | Crain's Chicago Business

Raising the limit for Jumbo loans would give larger home owners more options for where to get their mortgages. In the Chicago market the limit of $417,000 does not seem like such a large home.

Read this article for more....

Bigger home loans won’t spur more foreclosures: Realtors News Crain's Chicago Business

Read this article for more....

Bigger home loans won’t spur more foreclosures: Realtors News Crain's Chicago Business

Spring Cleaning Ideas

Quick Green Spring Cleaning Ideas

It’s too early to do much outdoors here in Chicago, which leaves us working inside with the sun shining on us. Here’s a few ideas!

1. Open the windows. The best way to get dirty air moving out and fresh air moving in is to open the doors and windows. Feel the breeze.

2. Skip the air fresheners. Buy fresh flowers! An open box of baking soda, cedar blocks, or dried flowers also add natural fragrance to the room.

3. Use vegetable-based cleaning products like those made with coconut oil. Many detergents are made from petrochemicals, just like expensive gas.

4. Nature’s cleaning miracle, vinegar can be used to clean just about anything. Use it straight to clean kitchen floors or wash windows, mix it with baking soda and essential oils to clean sinks and more.

5. Recycle what you are not using. Donate first. Then take items that don’t belong in our Blue or Black Carts to the City of Chicago site at 1150 North Branch Street for disposal of these items --- use the link here http://www.cityofchicago.org/city/en/depts/doe/supp_info/household_chemicalscomputerrecyclingfacilityoverview.html

Bucktown/Wicker Park closings this week: 2 Detached single family homes and 5 Attached homes –

1510 N Wood 3 bedroom 3 bath renovated house $640,000

2012 N Hoyne 4 bedroom 3 ½ bath house $708,000

2039 W Webster 3 bedroom 2 ½ bath end unit townhouse w/garage $375,000

2031 W Pierce #1A 2 bedroom 2 ½ bath duplex down condo with garage spot $385,000

2308 W North #3W 3 bedroom 2 bath condo with garage spot $388,500

1750 N Wolcott #203 2 bedroom 2 bath loft condo w/garage spot $425,000

1919 W Crystal #102 3 bedroom 2 bath duplex w/garage spot Bank Owned $534,000

*** Information sourced from MREDLLC;3/13/11. Attached Property and Detached Property residential Bucktown (Ashland, Western, Fullerton, North) and WickerPark (Ashland, Western, North, Division)

Have a topic you’d like to see explored or a real estate question send it in.

If you’d like more information on properties currently on the market or selling your home just drop me a note at EvaB@atproperties.com

Tuesday, March 15, 2011

South Loop condo tower converting to apartments | Residential News | Crain's Chicago Business

The rental market is strong in Chicago and this conversion will bring vitality to a vacant building.

South Loop condo tower converting to apartments Residential News Crain's Chicago Business

South Loop condo tower converting to apartments Residential News Crain's Chicago Business

Sunday, March 13, 2011

Growing Vegetables in Containers

Spring is here! Well at least the calendar says so. Sunlight is increasing and temperatures will follow soon.

My thoughts are towards planting flowers and vegetables for the deck and the yard. I'm fortunate to have a garden, yet I supplement it with some potted plants. The following link is helpful with ideas, how to's and a list of plants that can do well in pots on the deck.

Enjoy!

http://www.howdididoit.com/home-garden/how-to-grow-vegetables-in-containers/

My thoughts are towards planting flowers and vegetables for the deck and the yard. I'm fortunate to have a garden, yet I supplement it with some potted plants. The following link is helpful with ideas, how to's and a list of plants that can do well in pots on the deck.

Enjoy!

http://www.howdididoit.com/home-garden/how-to-grow-vegetables-in-containers/

Friday, March 11, 2011

Electric Cars need Charging Stations....

An interesting article, with some price points, for condo buildings or single family garages that might want a Charging Station for their new Electric Cars.

Charging stations pose obstacles for condos - chicagotribune.com

What do you think? I might plug in....

Charging stations pose obstacles for condos - chicagotribune.com

What do you think? I might plug in....

Thursday, March 10, 2011

Spring Spaces in the Pipeline

SPACES: Real Estate Usually Comes into its Own During the Spring Season

Made possible by Eva Bergant,

Made possible by Eva Bergant,

Could it be Spring?!

We've had our first taste of warmer weather, the birds seem to be arriving, and the Flower and Garden Show is at Navy Pier!

In the spring we see the largest number of homes/condos on the market. Spring is about choices, and Real Estate, which comes into its own in spring, reflects this time of new beginnings and options. The market perks up. Snow has melted. Storm windows will soon be a memory.

|

Click to Enlarge |

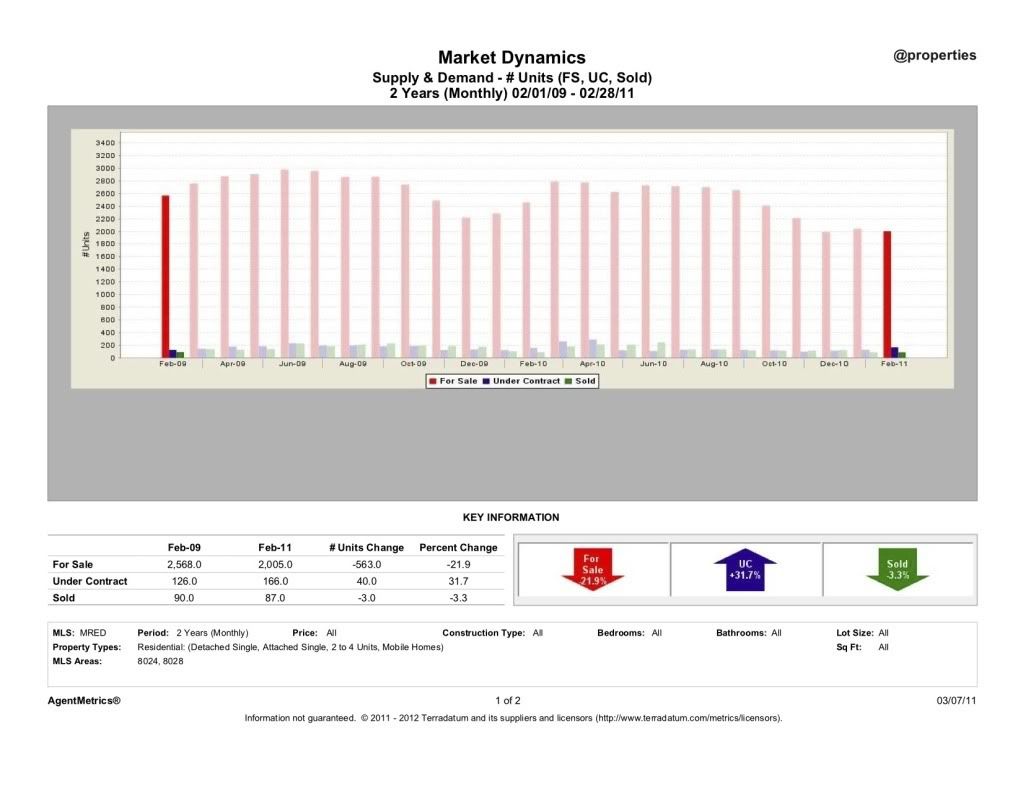

Check out the graphs of 1) the number places on the market and 2) the number of places under contract and sold in the last 24 months.

Are you thinking of making a change? Spring buyers go on the hunt while smart sellers and REALTORS know that there's no time like the spring to get prepared for a beautiful summer. Sellers who are part of the spring market have been working hard to prepare their homes for sale. Offers made now will most likely have mortgages approved in 30-45 days and closings in 2 months.

|

green shoes from John Fluevog that don't have anything to do with real estate-- as far as we know. |

In Bucktown/Wicker Park, there were NINE closings this week: 2 were detached single family homes and 7 were attached homes. They are as follows:

1316 N Leavitt 4 bedroom 3 ½ bath modern 3 story home $712,000

1956 W Evergreen 5 bedroom 4 ½ bath restored Victorian with a 1 bedroom 1 bath coach house on a 25 x 171' lot $1,250,000

1232 N Milwaukee #4 2 bedroom 2 bath condo with parking Short Sale $279,000

1744 W Division #1 2 bedroom 2 bath duplex with garage Foreclosure $305,000

1890 N Milwaukee #4D 3 bedroom 2 bath penthouse condo with tandem garage parking $332.000

|

Flower earrings, like these, spotted at store B vintage, bloom all year long on your ears |

1625 W North #201 3 bedroom 2 bath duplex condo with 2 garage spots Foreclosure $336,650

2010 W Potomac #C 2 bedroom 2 ½ bath townhouse with 2 garage spots $466,000 (market time 5 days!!)

1919 W Crystal #103 3 bedroom, 2 baths duplex with garage Bank Owned $515,000

1736 W Le Moyne #1 3 bedroom 2 ½ bath Duplex condo with garage $613,400

*** Information sourced from MREDLLC;3/7/11. Attached Property and Detached Property residential Bucktown (Ashland, Western, Fullerton, North) and WickerPark (Ashland, Western, North, Division)

Do you have a topic you'd like to see explored, or would like more information on properties currently on the market, or selling your home, drop me a note at EvaB@atproperties.com

In brief: Bucktown | | Crain's Chicago Business

a Vegan location coming to Bucktown.... read on....

In brief: Bucktown Central Park of Lisle Prime Group REIT News Crain's Chicago Business

In brief: Bucktown Central Park of Lisle Prime Group REIT News Crain's Chicago Business

Tuesday, March 8, 2011

Luxury Real Estate Market Report

For those of you who are in the Luxury Market in Real Estate - please take a look at this LuxuryPortfolio Information Click to see presentation This includes World Wide Properties - I hope that you are in this market!

Thursday, March 3, 2011

Check into the condo association when buying or selling

On Monday February 28 the Chicago Tribune ran this article, by Mary Ellen Podmolik. It points out one large item that the buyer does not have the ability to change when looking at condos--the ability to obtain a loan when the building does not meet lenders' criteria.

There are at least five criteria that can eliminate a building from receiving a loan from any Fannie Mae, Freddie Mac or FHA lender (most of the lenders!).

1 How many units in the building are currently rented? Lenders prefer owner occupied buildings, so the lower the number the better.

2 What is the financial position of the condo association? What are the reserves? While there is no set rule, the budget needs to show that adequate reserves are kept. The association needs to be collecting all the monthly assessments, delinquent units may make the building unqualified.

3 Is there any outstanding litigation with the condo association? Financial liability by the association can cause lenders to walk away.

4 In a brand new building, what is the percent of units sold? For an FHA loan it must be at least 51%, for conventional loans generally over 70%.

5 How much of the building is commercial space? If it's over 25% of the square footage, no loan.

For more information, please read the Tribune article.

In Bucktown/Wicker Park there were nine closings this week.

Do you have a topic you'd like to see explored, or would like more information on properties currently on the market, or selling your home, drop me a note at EvaB@atproperties.com

About Eva:

Eva Bergant is a Bucktown resident and local Realtor with a community driven style. In addition to being the president of the Bucktown Community Organization (BCO), Eva has served as chair for the annual Bucktown Garden Walk for the past three years. You can reach Eva by email or at 312-543-6819.

Friday, February 25, 2011

Green Parking to be built in Bucktown

Interesting elevators for your car when you come to the Bucktown and Wicker Park Area...

http://neighborhoods.redeyechicago.com/bucktown-wicker-park/bizspot/2011/02/23/robots-set-to-help-park-your-car/

http://neighborhoods.redeyechicago.com/bucktown-wicker-park/bizspot/2011/02/23/robots-set-to-help-park-your-car/

Wednesday, February 23, 2011

Tuesday, February 22, 2011

Homeownership and occupancy

This is one of several articles coming out today on Chicago home ownership.

Please note that this new low is 67.2%

In the second quarter of 2002, the rate was 66.7%....

From 1996 to 2010, the average local quarterly rate was 67.8%... The highest ever was 71.2% during third-quarter 2006.

Homeownership hits new 8-year low as residents seek refuge in renting Residential News Crain's Chicago Business

Please note that this new low is 67.2%

In the second quarter of 2002, the rate was 66.7%....

From 1996 to 2010, the average local quarterly rate was 67.8%... The highest ever was 71.2% during third-quarter 2006.

Homeownership hits new 8-year low as residents seek refuge in renting Residential News Crain's Chicago Business

Friday, February 18, 2011

First Impressions Matter

Spaces February 14, 2011

First impressions matter

It is widely accepted that a lasting first impression is made in 30 seconds or less, perhaps as little at 7 seconds. Whether you are meeting the date of your dreams, or searching for the home of your dreams the initial presentation counts!

Over 80% of home/condo buyers start their search online at national sites, or local ones. In either case the buyer is creating their first impression from the photos and descriptions available. The exterior “curb appeal” must present a welcoming face to the buyer – shining windows, great doorway, nice building, landscaping and decorating that shows it off well.

Decorating or staging your home is critical to position your home as better than the competition at that price. This can be as simple as rearranging furniture, subtracting items and adding current fashion touches, or hiring a professional to refurnish and redecorate rooms or the entire home.

A few of the easy and inexpensive tips are:

· Clean and shine everything. Add lamps that bounce light off the ceilings. Use light curtains open to the clean windows.

· Put away personal items while removing clutter and out of season items from the closets and rooms.

· Paint and make minor repairs.

· Use colorful accessories such as pillows, vases, and rugs. Keep the background more neutral so the buyer can see the space and how they will occupy it.

· Arrange furniture for easy traffic flow and obvious uses. Avoid blocking doorways and using rugs that trip.

· Keep kitchen counters clean and clear of all items, including the front of the refrigerator.

· Get new matching towels, bathmat and shower curtain. Put away your personal items. Shine and clean every bathroom surface.

· Display fresh flowers that complement your color scheme.

· Treat your outdoor space as a room in the home with its’ own décor.

· Make the home inviting to buyers and give them enough space to see themselves living there.

Bucktown/Wicker Park closings this past week***: One detached single family home at 1439 N Elk Grove, 4 bedroom 4 ½ bath stunning contemporary for $1,475,000. One attached single family 1919 W Crystal Unit 203, 2 bedroom 2 bath contemporary duplex $447,000.

*** Information sourced from MREDLLC; 2/13/11. Attached Property and Detached Property residential Bucktown (Ashland, Western, Fullerton, North) and WickerPark (Ashland, Western, North, Division)

Have a topic you’d like to see explored or a real estate question send it in.

If you’d like more information on properties currently on the market or selling your home just drop me a note at EvaB@atproperties.com

Monday, February 14, 2011

Downtown condo sales hit new low in 2010 | Trend Of The Week | Crain's Chicago Business

Selling 498 units of the 3000 in the market is a tough loss ... and most of these units are in just 30 buildings downtown. New lower pricing has helped buyers and sellers come to agreements, but there is a long tail to this absorbtion.

Downtown condo sales hit new low in 2010 Trend Of The Week Crain's Chicago Business

Downtown condo sales hit new low in 2010 Trend Of The Week Crain's Chicago Business

Thursday, February 10, 2011

More than half state's 2010 homebuyers were first-timers | Residential News | Crain's Chicago Business

Here's a piece from Crain's Chciago Business.

First time buyers in Illinois were more than 50% of the buyers this year - mostly from the federal credit in the early part of the year. This also accounts for the significantly lower numbers of purchases in the later part of the year. ... a slow down of business... a lack of federal stimulus to maintain the interest in buying.....

More than half state's 2010 homebuyers were first-timers Residential News Crain's Chicago Business

First time buyers in Illinois were more than 50% of the buyers this year - mostly from the federal credit in the early part of the year. This also accounts for the significantly lower numbers of purchases in the later part of the year. ... a slow down of business... a lack of federal stimulus to maintain the interest in buying.....

More than half state's 2010 homebuyers were first-timers Residential News Crain's Chicago Business

Wednesday, February 9, 2011

Monday, February 7, 2011

Location, location, location

Spaces February 7

The Blizzard of 2011 reminded us of a few things that matter -

Location. Anyone living close to a major street had a better chance of getting out that those living deeper in a Chicago neighborhood.

Access to public transportation. The Blue Line Blessing (and curse) falls on Bucktown and Wicker Park and surrounding neighborhoods.

Local businesses. Thanks to Chambers of Commerce and to all the small shops that provided neighbors with the missing essentials. Food, coffee, meals, banks

Good neighbors. Working together got sidewalks cleared, streets and alleys passable and many stuck cars moving again.

The saying in Real Estate is “Location, Location, Location” Those of us living in Bucktown and Wicker Park understand it! If you want to check out how other great neighborhoods stacks up, or your own address, go to WalkScore.com

Two detached single family homes closing this past week: (Average market time 485 days) 1870 N Wilmot 3 bedroom, 3 bath townhouse $555,000 and 1811 N Honore 4 bedroom 3 ½ bath house $1,460,000

Two attached homes closing this past week (Average Market Time 255 days)

1720 N Marshfield #110 2 bedroom 1 ½ bath loft condo with parking spot $325,000 and 2007 W Churchill #201 3 bedroom 2 bath condo, with garage $419,000

Have a topic you’d like to see explored a real estate question send it in.

If you’d like more information on properties currently on the market or selling your home just drop me a note at EvaB@atproperties.com

*** Information sourced from MREDLLC; 2/6/11. Attached Property and Detached Property residential Bucktown (Ashland, Western, Fullerton, North) and WickerPark (Ashland, Western, North, Division)

Subscribe to:

Posts (Atom)